World Schizophrenia Awareness Day, 2024

World Schizophrenia Awareness Day

Schizophrenia: Key Statistics | |

|---|---|

Number of U.S. patients | 2.8 million adults |

Number of approved drug treatments | 19 |

Patients lacking effective treatment | Approximately 40% |

Active clinical trials testing new treatments | 432 |

In honor of World Schizophrenia Awareness Day, we directed the IQuant Engine to generate an overview of the schizophrenia research landscape. One common perception is that schizophrenia is generally well-managed by drug treatments, but this belief is mistaken. We were surprised to find that 40% of schizophrenia still are not effectively treated despite the 19 drugs on the market to treat this devastating brain disorder.

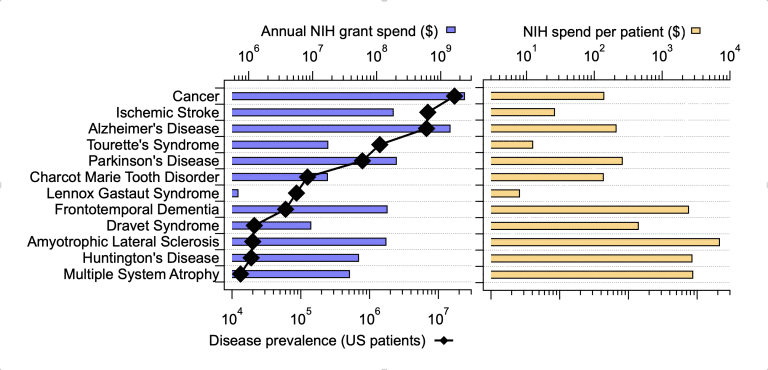

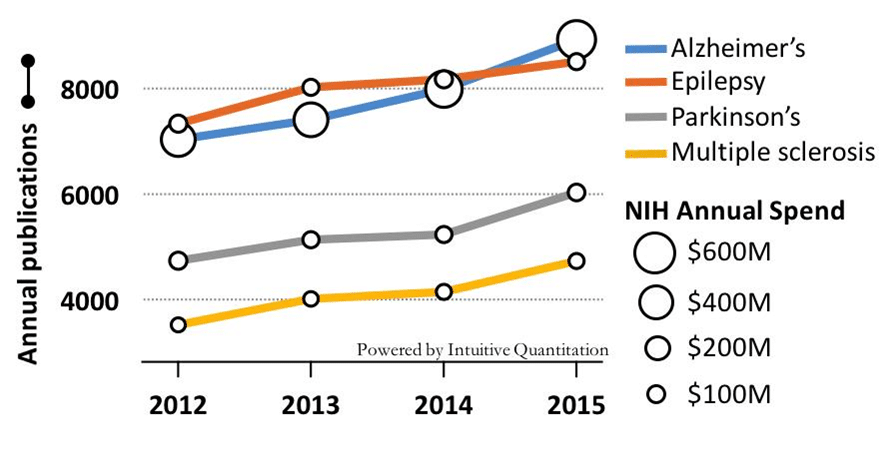

What is being done about this? NIH invests over $400M annually in grants associated with Schizophrenia research, approximately twice the funding going to Parkinson’s Disease and one-third the investment in Alzheimer’s. Clinical study activity in schizophrenia is quite robust with 432 active trials at all stages of development currently being run to test new treatments. This activity certainly brings some hope to the Schizophrenia research community.

Alzheimer's | Parkinson's | Schizophrenia | |

|---|---|---|---|

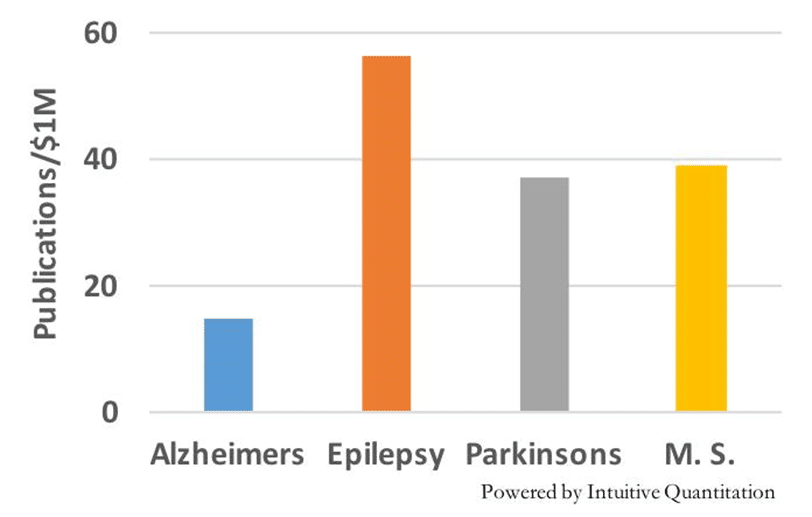

Annual NIH Funding | $1.4 Billion | $205 Million | $424 Million |

Scientific publications since 2000 | 202,692 | 144,850 | 19 |

NIH dollars per scientific report | $6907 | $1415 | $3721 |

US Patients | 6.9 Million | 1 Million | 2.8 Million |

NIH dollars per Patient | $203 | $205 | $151 |

Ways you can help beat Schizophrenia

Learn more about Schizophrenia in the US:

- https://en.wikipedia.org/wiki/Schizophrenia

- https://www.psychiatry.org/patients-families/schizophrenia/

Find clinical trials:

News about a new drug therapy:

- https://www.psychiatrictimes.com/view/fda-accepts-nda-grants-pdufa-date-for-investigational-schizophrenia-treatment

Let us know how we can help enhance your research.

We work with scientists, drug discovery professionals, pharmaceutical companies and researchers to create custom reports and precision analytics to fit your project's needs – with more transparency, on tighter timelines, and prices that make sense.